The changing market - Record High Inflation - BUYERS BEWARE!...and sellers

The Changing Market

We are seeing a change in the market and it is causing a panic. Well what is it and how can you hedge your bets against it and win in this market?

Let us talk about inflation for a moment as this is where the real issue is. For the last 2 years we have seen money floating around mostly from the federal reserve printing it at an uncontrollable rate. With all of this money being printed it is causing the value of money to decrease. The idea is simple, the more money that is available, the less value your money has when it comes to purchasing goods. Prices for those goods will inevitably increase as demand surges higher (because people have more money) and supply of those goods come down (because people with more money are purchasing those goods at a higher rate). Couple this inflation with artificially low interest rates, the likes of which we have seen for the last 2 years, and you have created the perfect storm for asset prices to skyrocket!

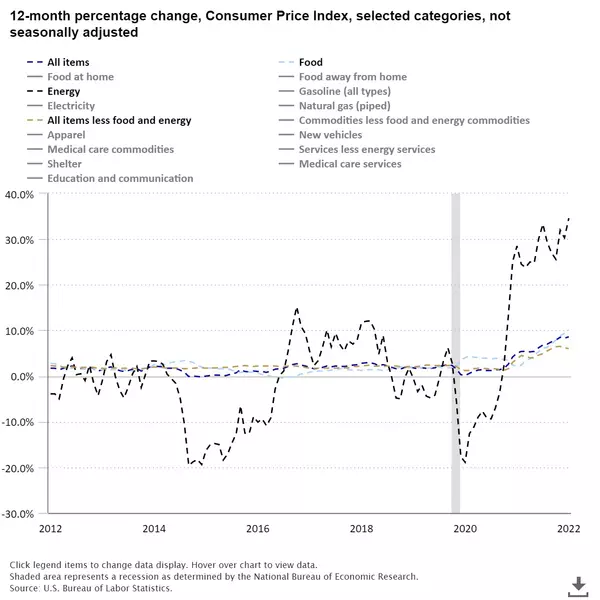

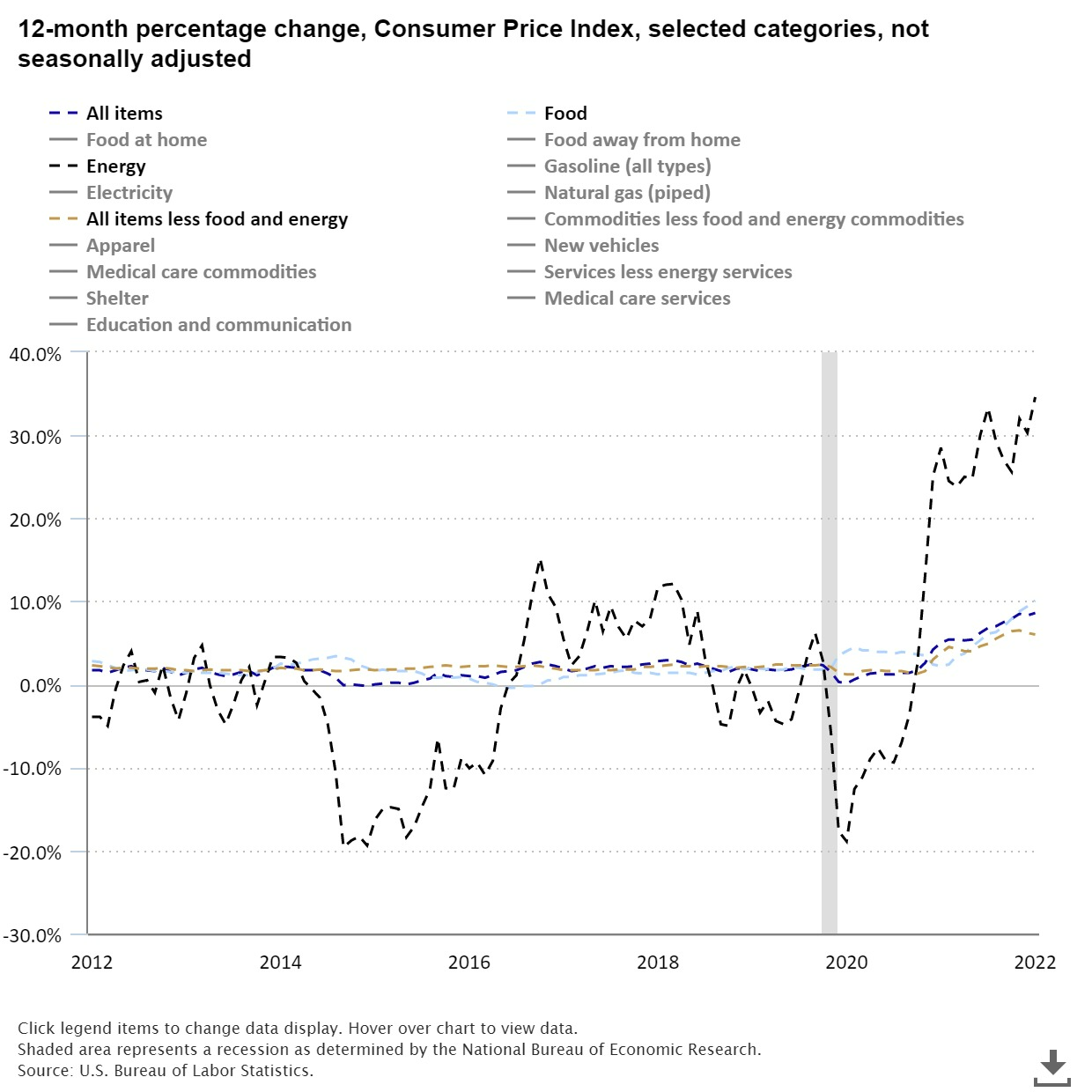

Now the dust is settling from this inflation storm and the consequences have made themselves very apparent. According to the recent CPI (Consumer Price Index) from the U.S. Bureau of Labor Statistics inflation had hit a high of 8.6%

Now that inflation has hit an unsustainable rate, the federal reserve has taken action and begun to raise interest rates. Most people see this as a bad thing, but the truth is that the fed does this to combat inflation. If money becomes more expensive to lend on, then buyers will be less likely to use their dispoable income on assets, investments, etc. This will hopefully cause prices to come down to a more affordable level.

There is one thing about this graph that is very telling of the market that we are in. As you can see, most of the selected categories are following a pretty standard trend, except for one: Energy. Energy tends to fluctuate over the years but none so much as it has in the last 2 years. Especially so in the last few months. This is directly attributed to a number of factors, but let's say it is mostly coming from the invasion of Ukraine as Russia is one of the biggest suppliers of oil to the world market.

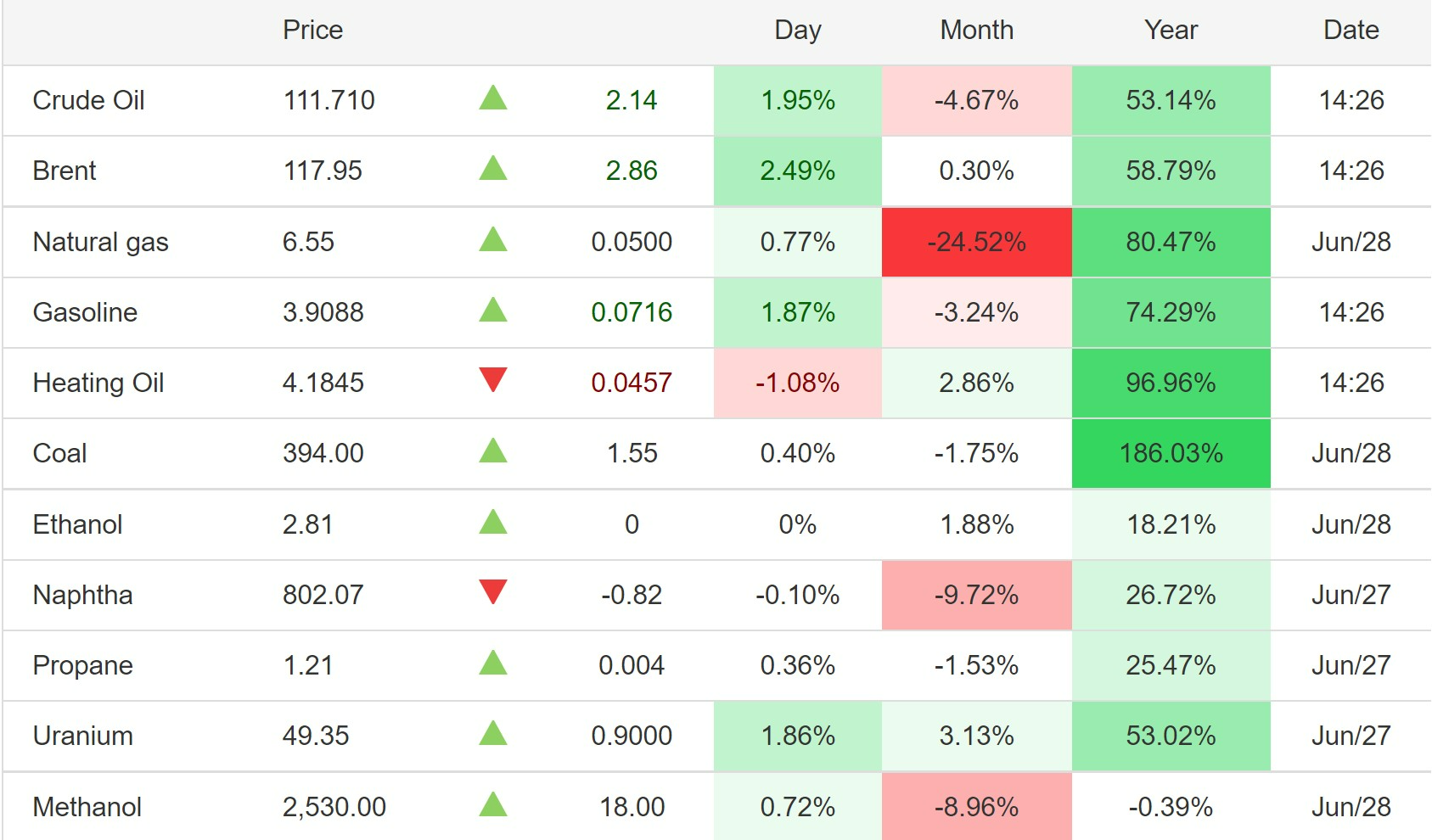

How does this affect the average person? Well as energy prices are rising, specifically the cost of oil, it affects our day to day as we use this oil to heat our houses and gas to fuel our cars. According to Trading Economics, the price of gasoline is up 72.49% year over year and in some cases it is well over that based off personal experience at the pump as well as what I see on the floating around on the media...

This is telling because it shows us that one of the main causes of consumer confidence diminishing is not just interest rates or plummeting asset prices, like stocks, but rather getting to work costs a lot more than it used to. Going on vacation costs significantly more than just a year ago and leisure trips might have to be put on the wayside. When you show up to the gas pump and gas is $5.00/gallon on average, it will make you think twice about spending your disposable income on things you do not need, like say maybe an investment/vacation property in beautiful Breckenridge Colorado.

Now this may all seem like we are heading for some kind of market crash, but I can tell you we are not. Does this mean I am a time traveller, have been to the future and know what exactly is in store for us? NO! The difference is in the market factors in this market as compared to the conditions in the last recession of the 2008 market crash. We aren't seeing folks in forebearance the way we saw in 2008. According to bankrate.com over 75% of the mortgages applied for today are from people with credit scores of 720 or higher. This is indicative of a strong buyer pool.

So where is all the fear coming from? Inflation in energy prices seems to be the main factor from the data. We are also seeing over inflated real estate in certain sectors and rising interest rates. None of this data is pointing towards a major financial downturn, but rather a softening of the market. How much depends on where you are located. We are likely to see primary residence markets dip heavier than luxury resort markets like Summit County Colorado as first time home buyers won't be able to afford as much home as they would have in the past. Luxury markets tend to be shelteres as they attract more seasoned investors and high net worth individuals who tend to pay for properties in cash.

The conclusion we can take away from all of this is that inflation is likely to stay at unprecedented levels for a little while and there is little we can do about it. So what is the best way to hedge against inflation? Historically it has been real estate. As inflation rises the value of real estate tends to keep pace with it. Couple that with other benefits of owning real estate such as rental income and prinicpal paydown it would be the better way to hedge against inflation as opposed to investing in a falling stock market.

Unfortunately with this period of record inflation we are likely to see the wealth gap widen further in this country making it harder for the average individual to afford basic necessities going forward. However, the wealthy have a widely known secret that has sheltered them from economic downturns in the past. Real Estate. As markets recess, real estate has stood the test of time because even in a downturn people still need a place to live. Some buyers become wary of buying in the short term and opt to rent instead which is why owning that real estate and realizing the revenue from that tenant is such a great way to beat out inflation and create long term wealth for yourself. The wealthy understand this and would much rather have their money sitting in real estate keeping up with inflation, than losing their purchasing power as their cash sits in the bank. You may think to yourself, well why would I invest in real estate when interest rates are the highest they have been in years? Well why were investors buying real estate in the 1980's when interest rates were 18.2%? Answer: Because real estate is the best hedge against inflation and best way to grow long term wealth. The business model of owning real estate is so well documented that if you are willing to do some due diligence and have an investor friendly agent, like Anthony Sole, on your side and you invest for the long term, you are going to come out on top!

Please take this post with a grain of salt. I certainly do not have a crystal ball, but like to base my findings off of data such as the data provided above. We may be headed for a recession, but one thing for sure is that investors will continue to invest in real estate and continue to grow their long term wealth by doing so.

Categories

Recent Posts